As always, there has been adoring media coverage of the Berkshire Hathaway AGM but, putting to one side the footage of WB chugging away merrily on Cherry Cokes and arm-wrestling footballers, there were two nuggets that provided me with food for thought.

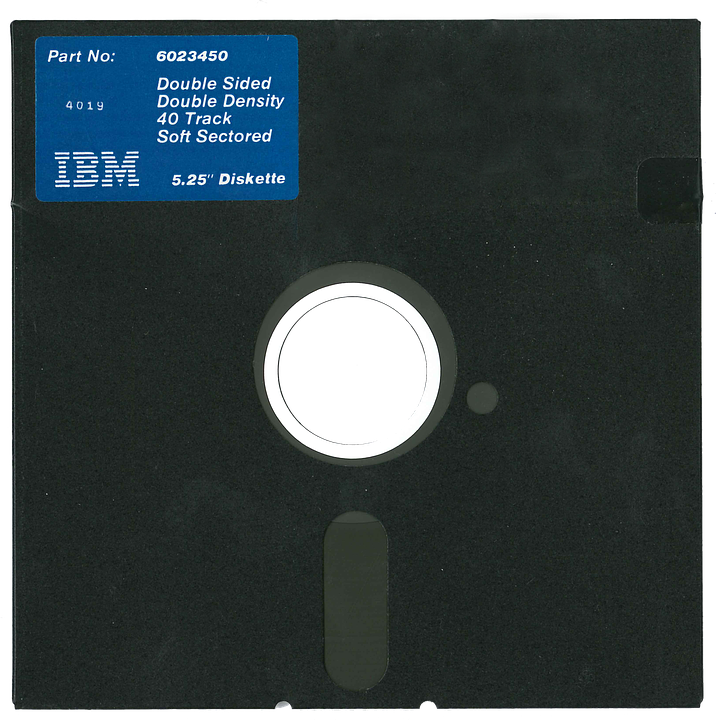

Bill Gates and IBM

Perhaps I have been naïve, but I had always assumed that, given both the close friendship between Buffett and Gates, and Gates’ status as a Berkshire Hathaway board member, Bill Gates was fully signed-up to Berkshire’s purchase of its huge (and it is huge!) stake in IBM. But… see this:

No, IBM became less of a technology company,” Mr Gates says. “It’s really sad. It turns out, at least so far, Warren was wrong. Even with the enterprise customers, the cloud has not been saleable for them. I’m biased. IBM is a wonderful company but because I competed with them for many, many decades I have to say, I don’t see their future as brightly as people who are long on the stock.

Did Buffett disregard Gates’ advice on buying into IBM? Did he even consult him at all? I wish the journalist had followed-up on this issue. If he didn’t consult Gates, then why not? Who on God’s great earth better to ask for advice on such an investment? And if he did consult him, then why would he overrule him on this of all subjects?

Finally, why would Gates seem to distance himself from “people who are long on the stock”? According to various sources, such as here, his Foundation has a remarkable near-60% holding in Berkshire Hathaway.

More questions than answers here, but it is disappointing to “people who are long on the stock” (myself, for example), that Gates seems so luke warm on the prospects for Big Blue.

Current Market Valuations

Secondly, Buffett opined on the market. He has a long record of speaking relatively rarely but frankly on the general level of market valuation and so it is usually worth paying attention when he does say something.

To paraphrase, he says that equity valuations should be looked at relative to the bond market. If rates were to remain at their current subterranean level for 10 years, then stocks are extremely cheap. If, however, rates normalize then stocks are on the high side. Either way, he goes on to say, stocks are definitely cheaper than bonds, which are very overvalued. If he could find a way to easily short the 20- and 30-year bond easily, then he would.

It certainly would be interesting to see what he is getting up to in his private broker account, but these comments are good enough for me. I will continue to regard the bond market as something to be approached with great caution. In fact, I might continue to not approach it at all, for a little while longer.

Anyway, check out the full interview for more detail.

Disclosure: Long BRK.b, IBM

Disclaimer: This post is not a recommendation to either buy or sell. Please consult your investment advisor.

Hasn’t WEB been wandering around telling anybody that will listen then he wants the stock to go down?

Pretty good way to get it to go down..

And I thought I could be cynical! I had never considered Bill Gates as a stooge or media plant, but you might be onto something… BTW, that hoping the price falls business is all very well, but it must be well over three years now. These de-ratings can become permanent.

Guilty as charged!

You make a good point, and I’m far from an expert on Buffett (or investing in general – just thinking out loud) – but if Buffett knows how much of their business is sticky, how much of a share in the company he’s willing to buy + their buyback plans then he’s probably got an idea of how much ownership he’s going to end up with, the difference between his purchase price and the value of the final ownership stake and the relationship of the two to the sticky business.

Also, isn’t Buffett matching insurance float to equity investments, in which case cash flow predictability probably figures as more important than total return (which he might figure he’s getting from the above repurchases?).

FWIW I’m probably way off base.

Regards,

Well I’m no expert either – just trying to make sense of this stuff as I go along. I think he probably knows how much–at cost basis–of a share he is willing to buy (don’t think he has ever added to his Coke holdings, for example, although he has said he would probably add as much to his Wells Fargo as he is allowed to), but he also has a fairly good idea of what he is going to end up with. I think his ownership of IBM has already increased 15% due to their buybacks alone.

I know he has restrictions related to his insurance float (he speaks about keeping 20 bill in short duration treasuries for this purpose), but remember he also has huge earnings coming in from the likes of BNSF, See’s Candies, Heinz, Iscar and whatever else that–theoretically–he can invest however he wants. These cash flows he can control, but he can’t control what happens to the cash flows from Coke or IBM–they could cut their dividends tomorrow without him being able to do much about it.

Thanks for your comments.

Pleasure! Thanks for replying!

Regards,